Tricorner Group is a private investment firm partnering with exceptional entrepreneurs and executives to invest in and acquire growing, profitable, category-leading companies.

We are a patient and flexible capital partner with extensive experience working with management teams to drive growth, develop executive teams, and enhance brand and market position. We aim to complete only one or two investments each year, making us a highly selective investor able to devote a substantial amount of our time, resources, and personal networks toward being a supportive partner.

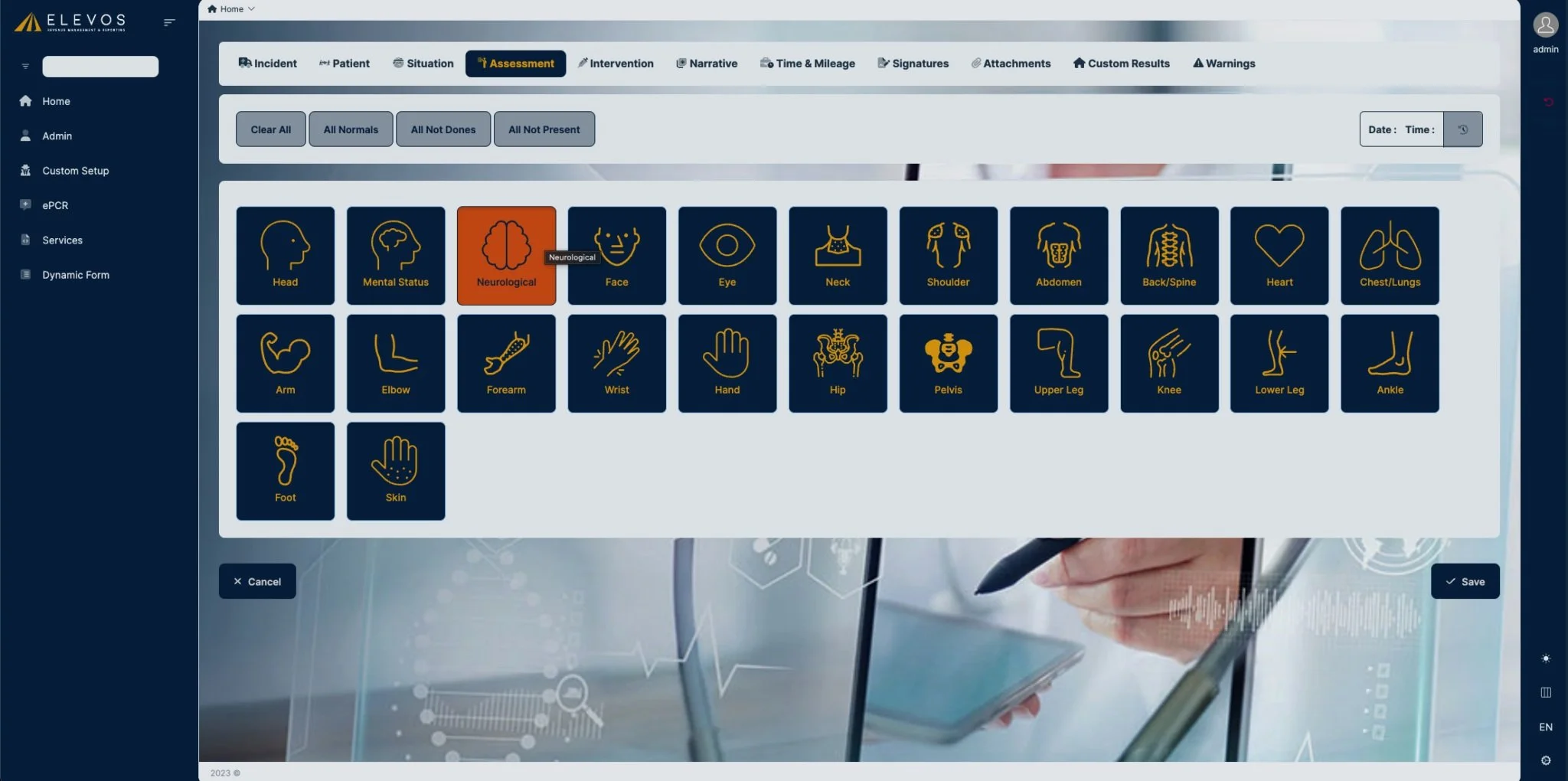

We invest in and have significant experience in a broad array of industries. As we develop relationships in certain industries, we will naturally build a deeper concentration in each – such is the case with our focus in the business services. Across our current and realized portfolio, we have invested in a total of 16 business services across the following verticals: IT services; healthcare software (SAAS); revenue cycle management; and computer recycling.

Because we are not a traditional private equity firm, we are not constrained by fund specific hold periods, limitations around investment structuring, or any other outside forces which may impact our ability to act in the best interest of the companies in which we invest. And because we are a small group, the Tricorner team members with whom you interact are the decision makers who speak for the firm.

We would welcome the opportunity to speak with you.

Areas of Focus

-

Industries of Interest

Business and Tech Enabled Services

Software

Healthcare

-

Transaction Structures

Majority or minority recapitalizations and growth equity investments

Ideally the first institutional capital

Capital used to:

Fund organic or acquisition-led growth

Recapitalize a company, buyout a shareholder, diversify founders’ net worth

Acquire a minority piece of a business from founders or other shareholders

Economic alignment with company leaders through generous equity incentive plans tied to superior company performance

-

Company Traits

Closely held / founder-owned

Energized, highly capable CEO and executive team

Profitable, growth-oriented private companies with established, proven business models

Defensible competitive positioning